Compute payments for part-time and casual employees. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed.

Everything You Need To Know About Running Payroll In Malaysia

Using your formula 2000x2330 rm 1533.

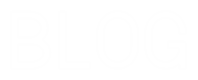

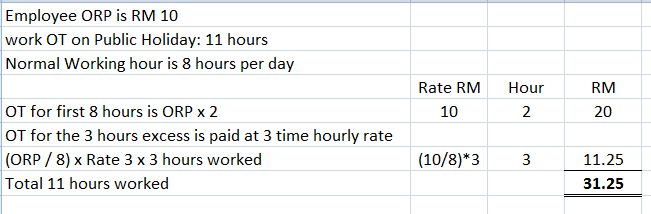

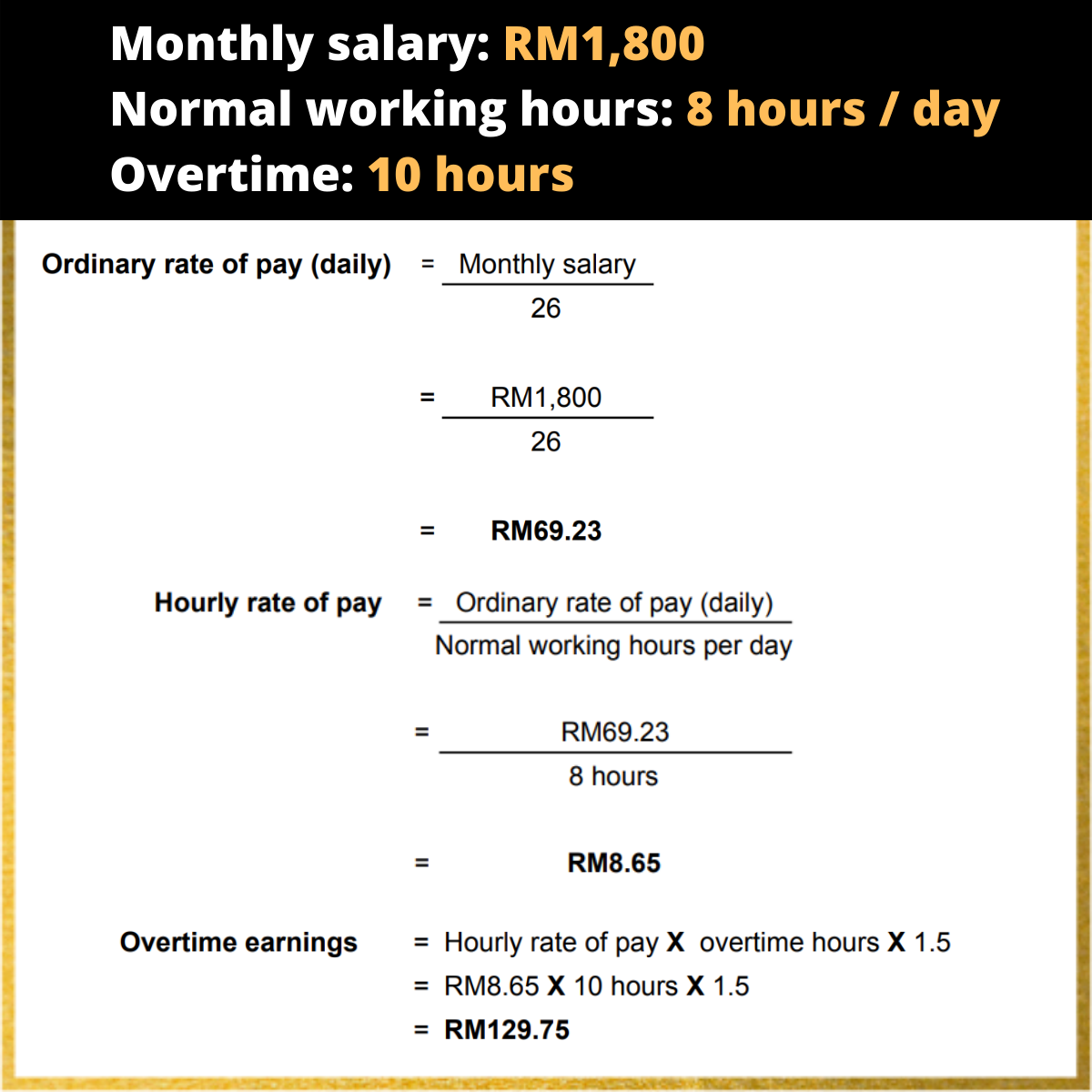

. Half day work is on a Saturday and Sunday is the default rest day. Correctly manage and compute the various employee benefits according to EA using the acceptable legal formula. Legal overtime rates are 15 20 and 30 on normal days holidays rest days respectively.

How much should be. Number of days in the respective month. Annual leave sick leave maternity leave public holidays rest days etc.

Multiply this number by the total days of unpaid leave. Basic Allowance Incentive 26 days 8 hours. Singapore Prorated Salary Salary for Incomplete Month of Work Calculator.

6th working day is on a Saturday and Sunday is the default rest day. Salary Calculation for Incomplete Month. Of working days worked OPR.

Less than 2 years 4 weeks of salary. Download the table of working days per month for 2021 and 2022. Flexi has RM200000 According to the EIS contribution table.

Salary are paid once a month and must be paid within 7 days after the end of the salary period. An employee monthly rate of pay is always fixed to 26. Manual calculation of unpaid leave.

YEAR 2021 YEAR. Unless with boths agreement of termination notice and if not the payment terms will be as written. The calculator is designed to be used online with mobile desktop and tablet devices.

Monthly gross rate of pay Total number of working days in that month x Total number of days the employee actually worked in that month. Press alt to open this menu. Using actual work day formula 2000x2323 rm 2000.

Take their annual salary and divide it by 52 to get their weekly salary. Employee Starts work on 1212016 his salary is RM 1000. Flexi has a salary of RM2000 per month how much does he has to contribute to SOCSO.

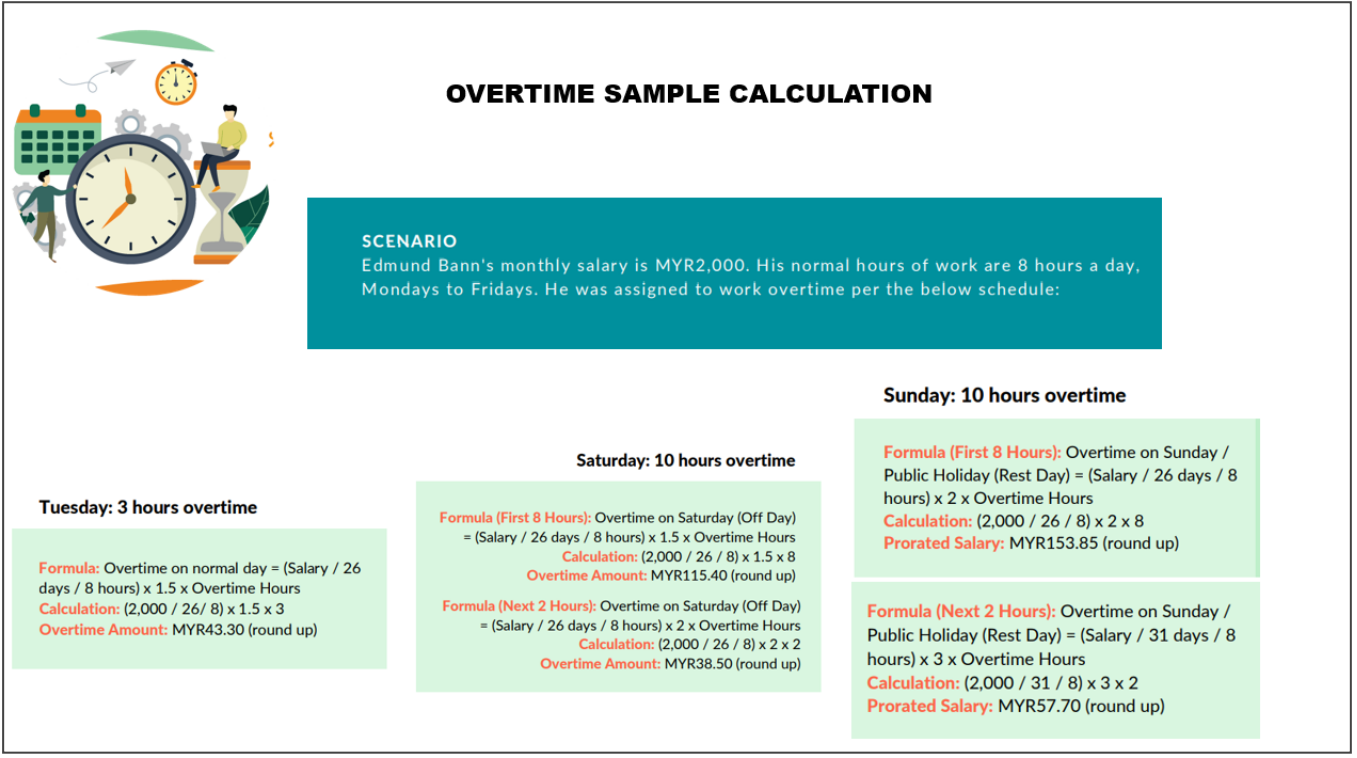

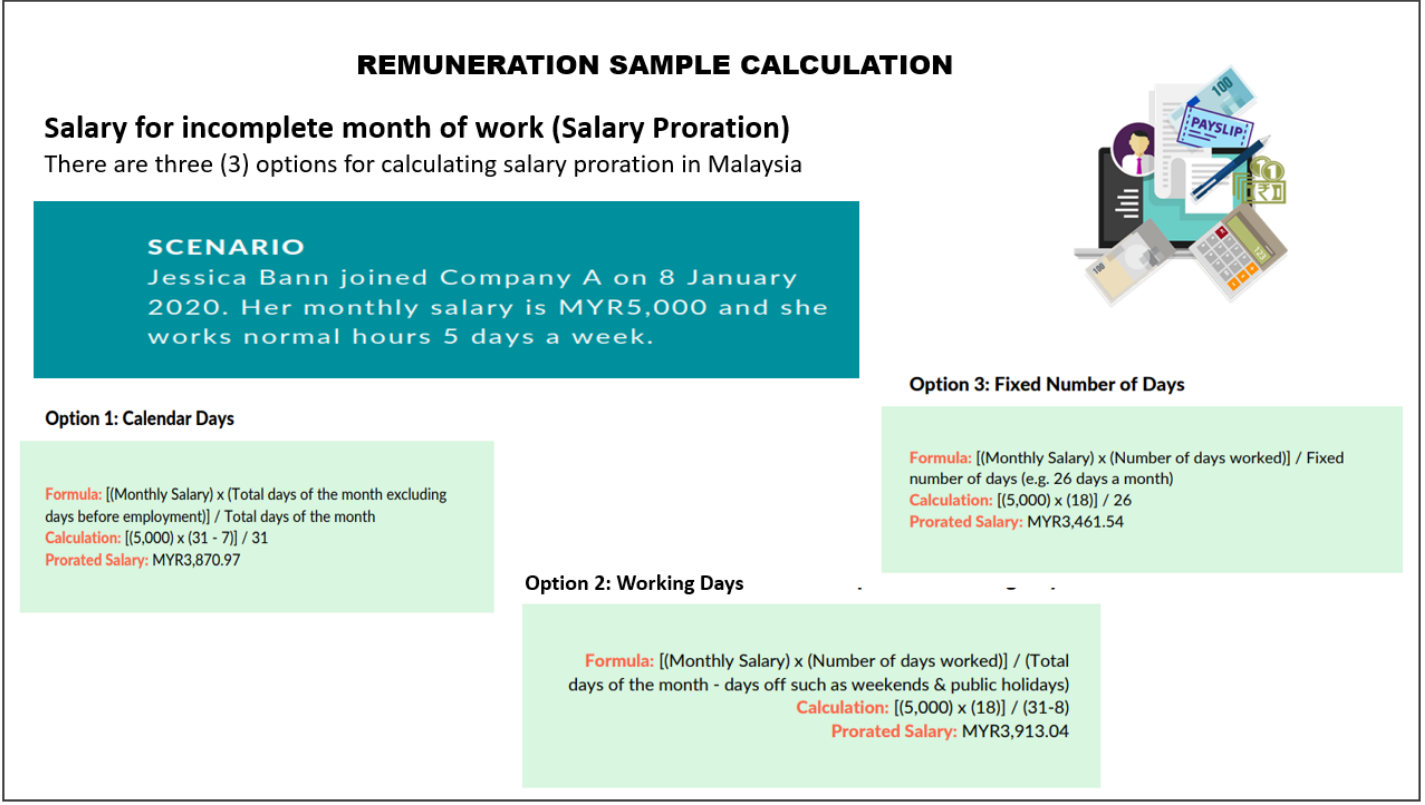

Example for Working days in Current Calendar Month. Payment for termination notice. Calculation of Salary For Incomplete Month of Work Calendar No.

Under the Minimum Wages Order 2016 effective 1 July 2016 the minimum wage is RM1000 a month Peninsular Malaysia and RM920 a month East Malaysia and Labuan. A gross pay 22 X working days. You can determine their daily pay by dividing their weekly pay by the number of days in their working week if the employee.

This calculator which calculates salary for incomplete month of work is catered to employers and employees of all industries including service industries eg. This calculator is for months worked in 2021 and 2022. Working days in Current Calendar Month including public holidays All Days in Current Calendar Month.

At year 2 and less than 5 years 8 weeks of salary. C For the purposes of this section section 60 section 60D 3 a and section 60I normal hours of work means the number of hours of work as agreed between an employer and an employee in the contract of service to be the usual hours of work per day and such hours of work shall not exceed the limits of hours prescribed in subsection 1. Overtime Based on the Malaysian Employment Act 1955 overtime hours are limited to 104 hours per month.

Annual Salary After Tax Calculator. Salary for January 2016 RM 1000 x 20 31 RM 64516. Of Month days Sundays Saturdays DaysWeek Days week Daysweek January February March April May June July August September.

An employee weekly rate of pay is 6. Exceptionally if the work is of a continuous nature shift work it can be 8 consecutive hours with a paid period of rest not less than 45 minutes 5. What are the required statutory deductions from an employees salary.

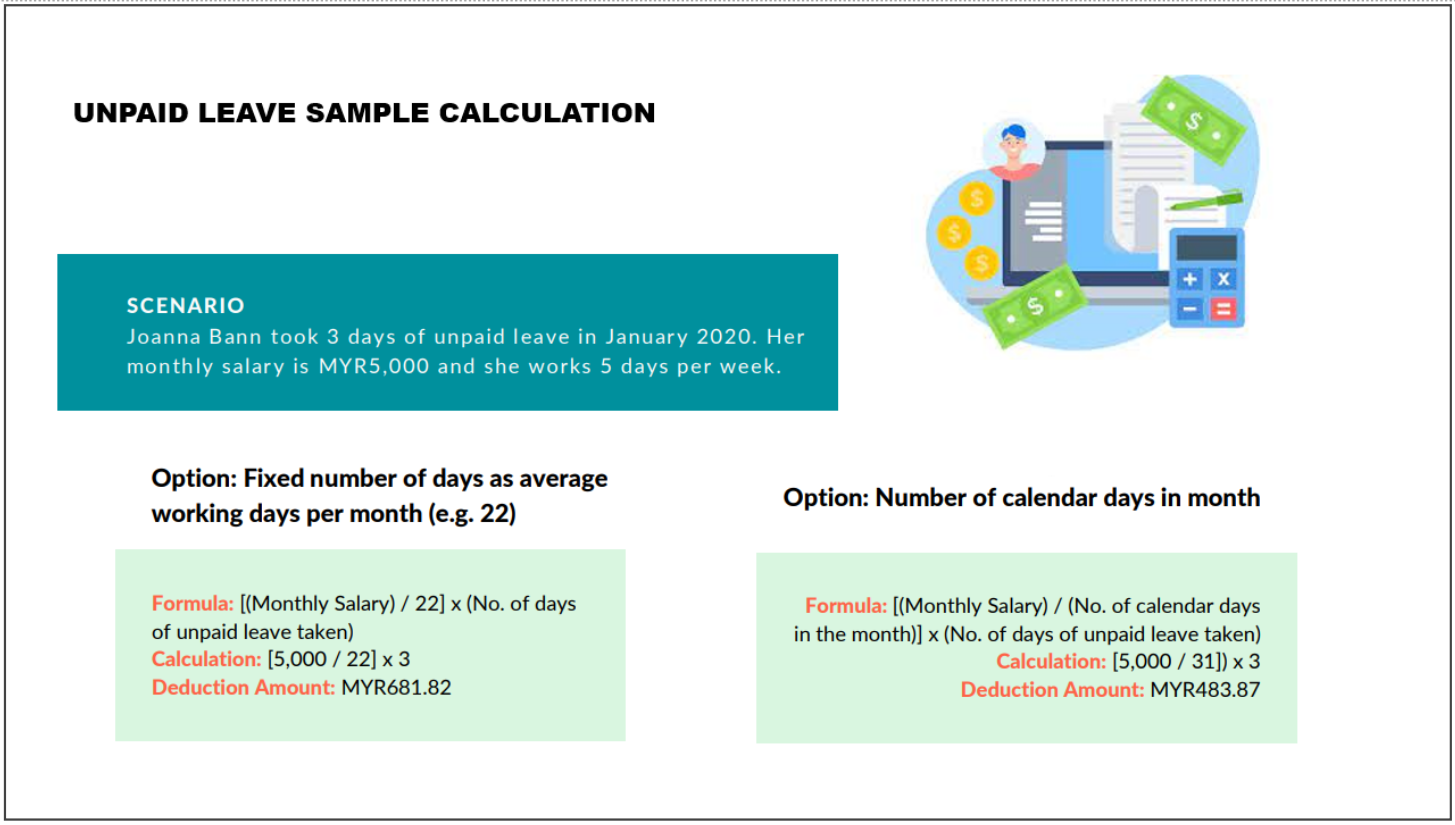

Formula calculation salary - commencement of employment incomplete month salary Jump to. Jim earns RM4000 a month and takes 3 days unpaid leave in March 2021. The Overtime Payroll Calculation is used to calculate income based on overtime rates for work performed after normal working hours holidays and weekends.

Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month. Find the number of working days in the current month. Pay for an incomplete month of work.

For more details on the minimum wage please read our previous article here. Not salary x work day 30 i give u example u have rm 2000 salary and you worked in oct19 and there is 31 days 8 days weekend and you only work for mon-fri and you have attended all work days. Review the full instructions for using the Malaysia Salary After Tax Calculators which details.

Pay for working 23 days in January 2017. Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators. Sections of this page.

These payroll rates apply to all employees who fall within the definition of the Malaysian. Thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. MALAYSIA PAYROLL rules and regulations 1.

Fixed Number of Days. If you are a monthly-rated full-time employee use this calculator to calculate your salary for an incomplete month of work. Of working days worked Basic salary 26 x No.

The result is based on the following formula. Salary Formula as follows. Here we will provide a certain example for EIS Contribution calculation that referring to EIS Contribution table.

More than 5 years 12. Pro-rated salary for an incomplete month Basic salary No. Salary with fixed allowances X 12 months X years of services divided by 365 days.

At Talenox we believe in designing HR experiences for people not. To calculate the daily rate you can divide the monthly salary by either of. B gross pay 26 X working days.

Calculate unpaid leave and early leaving or late joining of employment in the month. Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate. Hi 1how to calculate the salary for an incomplete month for new staff.

Not exceeding an average of 48 hours in a week over any period of 3 weeks. Replied by munirah on topic Salary calculation. From RM190001 to 200000.

ST Partners PLT Chartered Accountants Malaysia. Of working days in the month x No. Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020.

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. How to Perform Salary Calculator Malaysia. FB retail professional services.

2what formula to use to calculate monthly salary.

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Key Amendments To The Employment Act 1955 Rodl Partner

Everything You Need To Know About Running Payroll In Malaysia

Salary Calculator Malaysia For Payroll System Smart Touch Technology

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

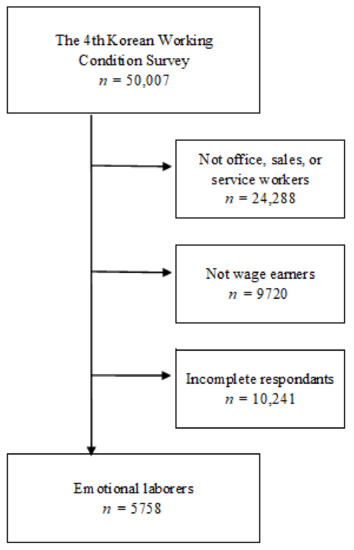

Ijerph Free Full Text The Importance Of An Emotional Expression Guide To Prevent Work Related Health Problems In Emotional Laborers Html

Calculation Of Salary For Incomplete Month Of Work Malaysia

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Everything You Need To Know About Running Payroll In Malaysia

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Salary Calculation Dna Hr Capital Sdn Bhd

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Everything You Need To Know About Running Payroll In Malaysia

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Salary Individual Income Tax And Social Security In Singapore Asean Business News